Thanks for joining us!

You will receive an email from us very shortly.

This email will include an invitation link to activate your exclusive and personalised Moorr, our in-house built online platform. Simply click on the link in the email, set up your password and you’re in Moorr!

Using Moorr’s Lifestyle By Design’s tools and resources, you can instantly gain clarity around your finances, stop overspending and start trapping piles of surplus cash - on autopilot and for FREE!

So what are you waiting for?

Head to your email inbox and check it out now.

p.s. If you can’t find the email, please reach out to our friendly support team here and they will be able to assist you right away.

As featured on...

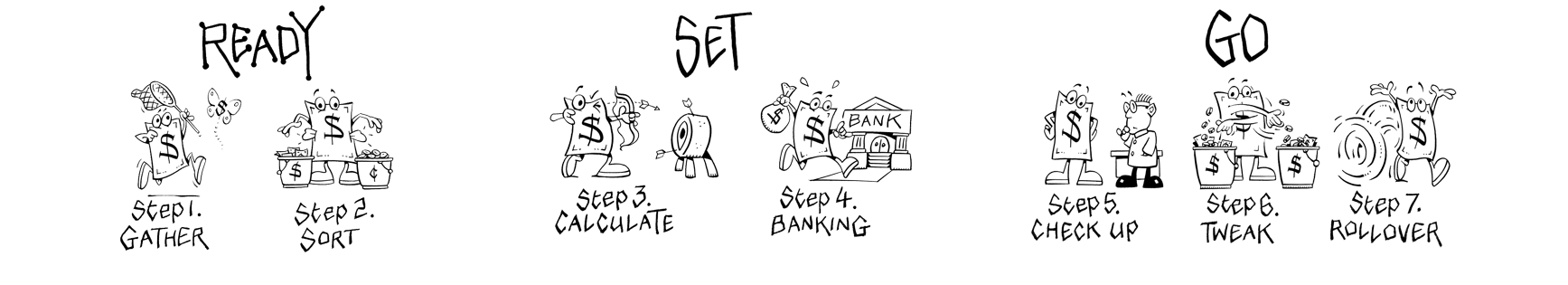

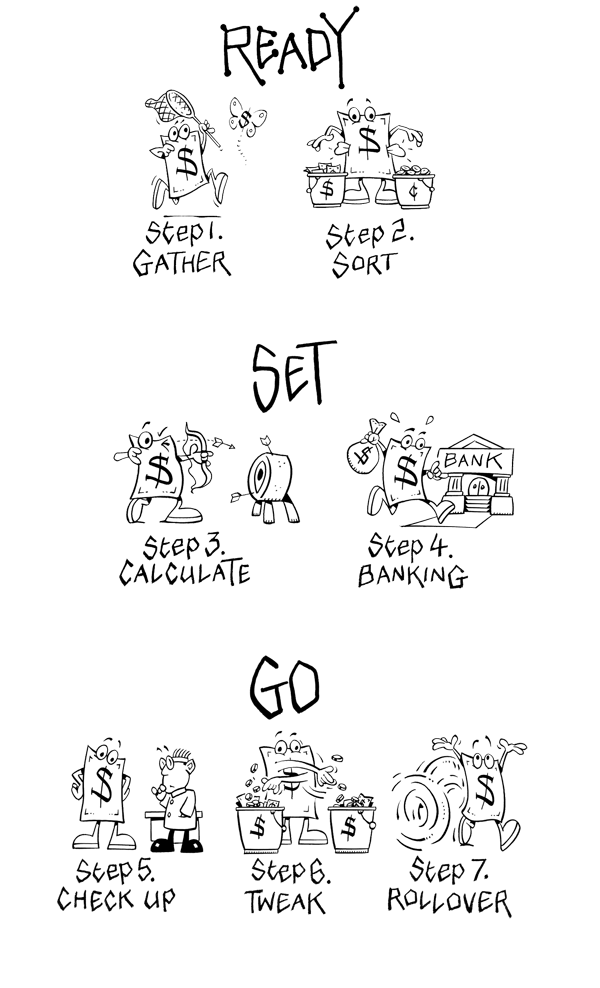

The 7 Steps to Implementing

Money SMARTS!

What Others Think About The Platform?

"Hi guys, I love your book and the Money Smarts system and I think it is AWESOME. I'm only 2 weeks in but am loving it, especially the 7 day float. My situation is a little different as a 50 year old who recently received a healthy redundancy after 20 years in the one gig and on top of that I've sold my house and am now "rent vesting". Before I look at traditional full time salary work again (if ever) I'm cognisant of the fact that my current cash nest egg won't last forever, so I was keen to know where my daily/monthly/yearly expenses were actually being spent for myself and my 2 teenagers. That's where the Money Smarts System has been awesome and the exercise of identifying where I had been spending is extremely worthwhile. Now I have piece of mind in knowing I can/should stick to my 7 day float, only use my credit cards for the known bills and chip away at the Provisions jar. And yes, come the end of the week it's surprising what you can whip up from leftovers in the fridge. It's also helping me stick to my 4 "alcohol free days" per week and heaven forbid, throwing in a couple of vegetarian meals per week - who knew meat was so expensive when you just threw it in the shopping trolley and used your unlimited credit card! Love your work and your podcasts. Cheers "

- Hadyn

"I am self employed so I can't use the system perfectly as it's written but I think I am applying it where it counts and trapping the surplus!

Started over a year ago and purchased an investment property in April which is doing nicely. Now preparing for the second one, building those buffers!"

- Peter

"Currently setting up the system as my property investment journey is just beginning. Very easy to follow and get your head around after taking the time to absorb the book. "

- Samuel

"Bryce and Ben have created a monster...platform that anyone can use. It’s already helped me become aware of discretionary spending that I can adjust to trap surplus for a rainy day!!

Not all heroes wear capes, although I can see the boys wearing superman capes in their next episode!!"

- Anthony

" It has given me a focus to work towards, I'm half way through the gather, sort, and calculate stages, but no where near execute, monthly check in or sweak, stages, The case studies are helpful, my New Years resolution will be to be in a much better financial space by this time next year! "

- Roma

"Money SMARTS is the most practical system to keep your money working for you without you having to think about it! While it involves maintaining a certain level of self discipline, it allows for plenty of self permission when it comes to spending money on what you value."

- Lindsay

"The Money Management System trumps budgeting because it provides a mechanism for checking up on your spending and keeping you accountable. Excellent!

I love the book as well as it gives a clear process for improving your financial situation, keeps you accountable for your spending, and gives you tools to ensure you stay on track toward financial freedom. "

- Ben

"My experience has been very good. Once you invest the time to understand your spending habits, and categorise your spend the whole management piece becomes second nature. "

- Kirk

" It's true it only takes 10 minutes once you have it up and running."

- Nicole

Latest Updates

Moorr brings together a range of next-gen financial tools and built-in money management systems that take the hassle, time and headache out of managing your money.

We've got more than 40 tools & features on the platform but we will not rest – the job is not done! Check out what’s coming up next on our Features page here >